Michael Le Roy, the new president of Calvin College, has made available much more detail about the college’s $115 million debt first reported in late 2012.

On Thursday, February 28, Le Roy posted a letter to the college community on the college’s website. “During the Lenten season we are reminded that renewal begins with the recognition of our brokenness, our acts of omission and commission, and our failures,” he wrote. “Perhaps it is no coincidence that we are communicating the results of Calvin College’s internal review of its financial situation during this Lenten season.”

Le Roy appointed an independent task force shortly after his arrival at the college last year to provide a complete review of the college’s financial situation. The entire task force report has not been released. Le Roy said he did not exclude anything substantial from the summary but withheld the full report because it contained personnel assessments.

However, Le Roy has posted his summary of the results of the task force’s findings. The website also has a letter from the president of the college’s Board of Trustees, Scott Spoelhof.

In an interview with The Banner, Le Roy said the reason for not disclosing more information sooner was primarily because the Calvin Board of Trustees did not meet until mid-February. He felt obligated to wait for that, since many of the recommendations involved board structure and governance.

In his summary, Le Roy wrote that there were multiple causes for the financial hole the college is in, most having to do with investment policy and financial management and with board oversight and governance.

Gaylen Byker, president of the college for 16 years before retiring last summer, told The Banner last year that 14 building and renovation projects had been completed on the campus during his tenure.

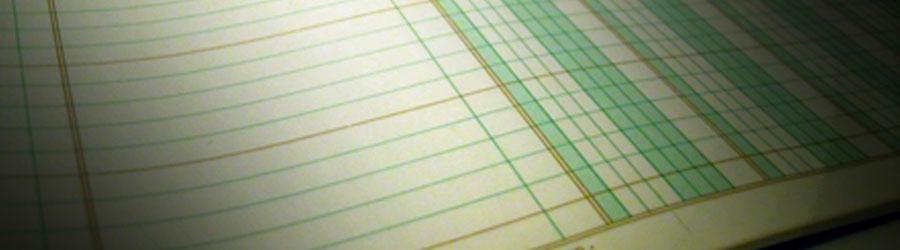

During that time, the task force reported, the college’s strategy had been to borrow money to build while investing donor funds for those projects in investments, in the hope that those investments would raise additional revenue. But the plan did not work as expected (see graphic). Instead,

- building project costs exceeded the amount of money raised by $30.8 million.

- real estate that was purchased for college use with no funds raised came to $5 million.

- the purchase of rental real estate adjacent to the campus resulted in a negative cash flow of $1.3 million.

- the negative difference between interest paid on debt and money raised from investments totaled $32.3 million.

That left the investment pool needed to generate the profit to service the debt short by $69.4 million dollars. As a result, payments on the college’s debt will soon have to come entirely out of the college’s operating budget. Those payments will consume approximately 9 percent of the annual operating budget, come 2017, assuming revenue doesn’t grow.

Additionally, Le Roy wrote, almost no payments to service the debt were built into the operating budget prior to this. “Calvin’s debt service payments . . . will grow to 9.2 percent by 2017,” he wrote. “We have not built more than 0.9 percent of the debt service payment into our operating budget.”

The college has already begun a process of prioritizing programs and strategic planning in order to meet that increased debt servicing a few years from now.

Budgeting practices have been significantly overhauled, including making sure debt service and amortization payments are fully visible in the annual operating budget.

But the board is also significantly changing its governance structure. It has created a new investment charter; the investment committee of the board must now be chaired by a board member, not staff, something Le Roy said is a best practice among colleges and universities.

“What was clear was that investment governance and administration practices had a lot of room for improvement,” Le Roy told The Banner. “We weren’t satisfied and have made significant strides [toward improvement].”

Le Roy also said he expects this will be the last formal communication about the situation. “I’m not anticipating saying more because I don’t think there’s more that has come to our attention,” he said. “The internal community of faculty and staff have a good grasp [on this] and are really focused on the prioritization and strategic planning processes that will carry us through.” However, his letter did note that there will be a telephone “town hall” meeting in March to give supporters the opportunity to ask questions.

On behalf of the board, Scott Spoelhof also posted a letter on the website. He wrote that the board is taking “a hard look at what brought us to this point.” He stopped short of an apology but acknowledged that Calvin “has been living beyond its means” and that “stronger board oversight may have detected the issues earlier.”

Calvin College is a liberal arts college in Grand Rapids, Mich., and is owned by the Christian Reformed Church. Its Board of Trustees are all appointed by synod (the annual leadership meeting of the CRC).

About the Author

Gayla Postma retired as news editor for The Banner in 2020.